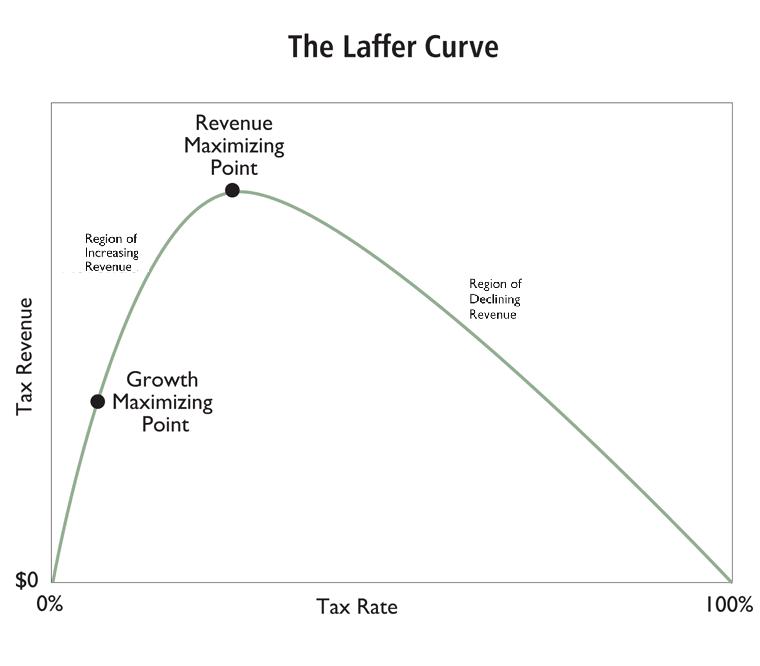

![PDF] Are State Corporate Income Tax Rates Too High ? A Panel Study of Statewide Laffer Curves | Semantic Scholar PDF] Are State Corporate Income Tax Rates Too High ? A Panel Study of Statewide Laffer Curves | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/f00715afd3a87fa9b01555bea7edddacbe552683/19-Figure1-1.png)

PDF] Are State Corporate Income Tax Rates Too High ? A Panel Study of Statewide Laffer Curves | Semantic Scholar

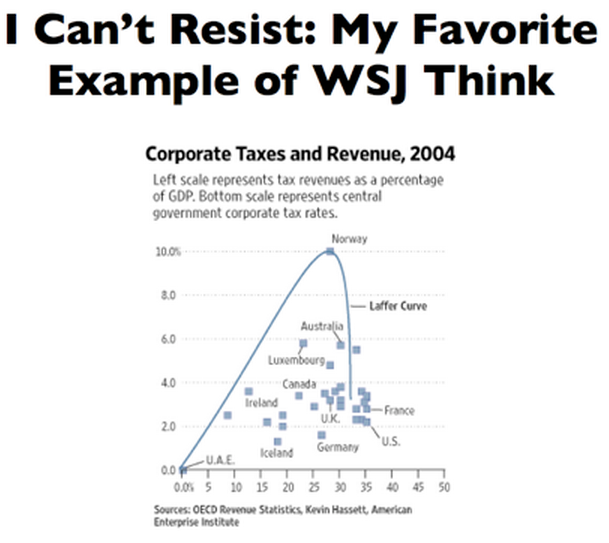

The Laffer Curve Strikes Again: Revenues Falling in Spite of (or Perhaps Because of) Spain's Punitive Corporate Tax Rate | International Liberty

Tax revenue and budget surplus for different levels of the corporate... | Download Scientific Diagram

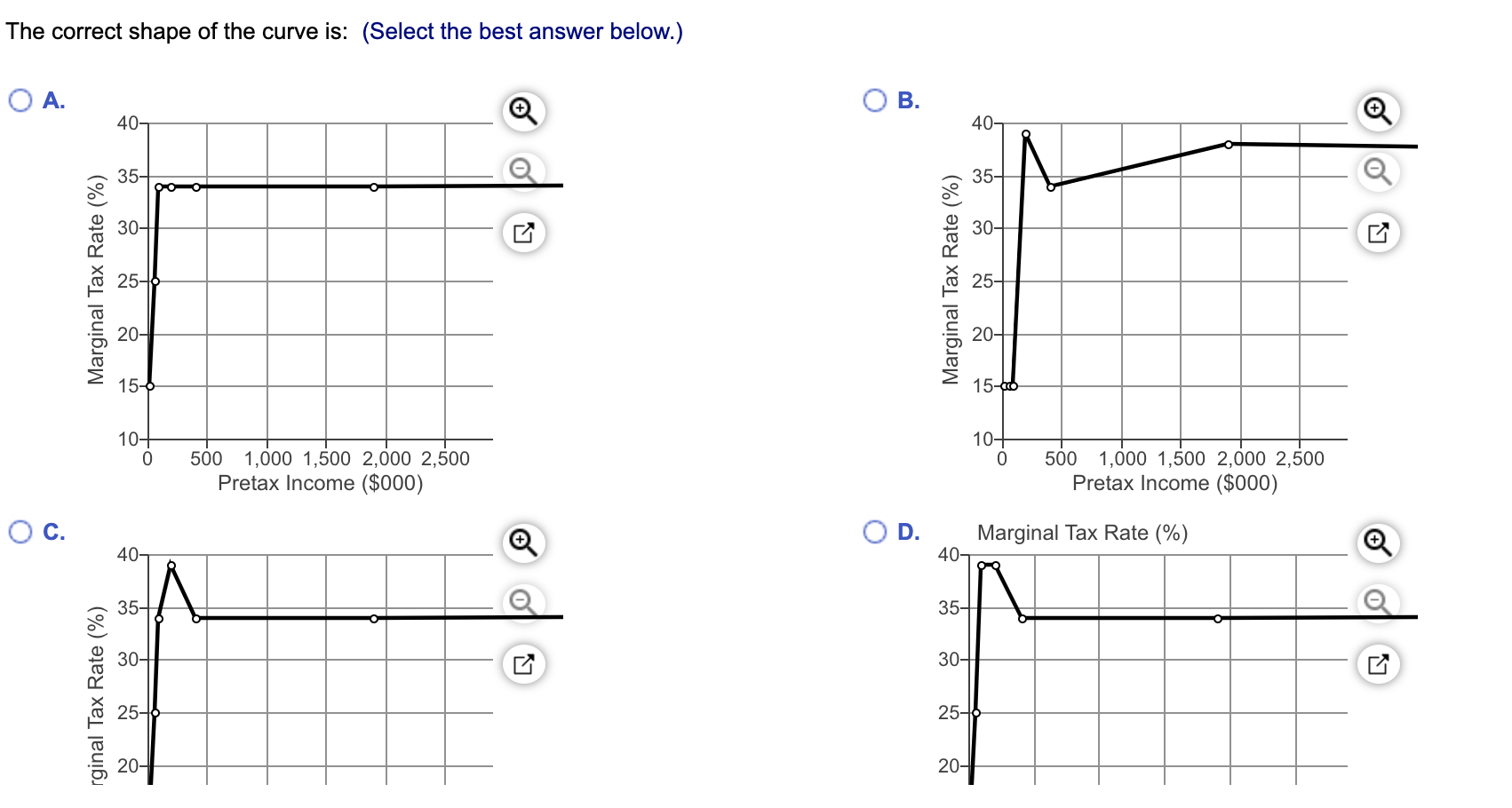

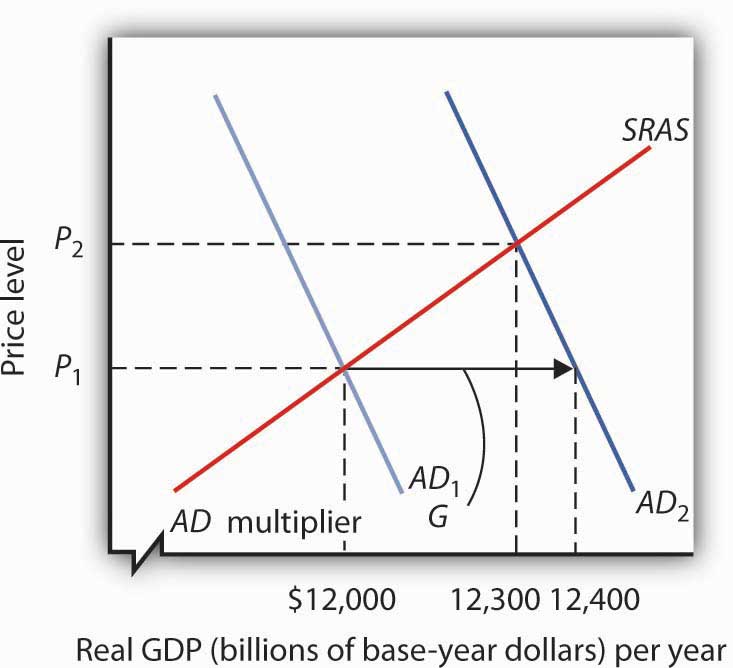

The new tax law dramatically decreases corporate income tax rates. Use the AD/AS model to analyze the likely impact of the tax cuts on the macroeconomy. Show graphically and explain your reasoning.

Who benefits from corporate tax cuts? Evidence from local US labour markets | Microeconomic Insights

Remarkable OECD Study on Corporate Tax Rates, Corporate Tax Revenue, and the Laffer Curve – Dan Mitchell